The practical, human guide to Student Finance USA: loans, grants, budgeting, and real strategies to reduce debt and thrive in college.

If the words Student Finance USA make you feel a mix of curiosity and dread, you’re not alone. Navigating college costs, applications, and repayments is a major life skill that isn’t taught in high school. This guide reframes Student Finance USA as an approachable process — one you can master with a few smart moves, a little paperwork, and some durable habits.

Throughout this article I’ll use the term Student Finance USA frequently because it’s the thread that ties scholarships, FAFSA applications, loan choices, budgets, and repayment plans together. Read on for practical advice, real-world perspective, and a clear path forward for handling Student Finance USA without losing sleep.

10 Digital Skills for Future-Proof Your Career in 2025

Quick overview (what you need to know now)

- Student Finance USA starts with FAFSA and scholarship searches — free money first.

- Federal loans are typically safer than private loans within Student Finance USA because of protections like income-driven repayment and deferment.

- Budgeting, small side income, and applying for micro-scholarships are powerful, underused tactics in Student Finance USA.

- Keep records: loan servicer info, balances, and annual paperwork are essential for smart Student Finance USA management.

Why Student Finance USA matters

The choices you make around Student Finance USA will influence more than monthly bills — they affect career flexibility, home-buying ability, and mental bandwidth. Understanding Student Finance USA lets you choose degrees and schools more strategically, borrow less, and set up a repayment plan that aligns with your life after graduation.

A simple mindset for Student Finance USA

Think of Student Finance USA as lifecycle money planning. Instead of treating borrowing and repaying as isolated events, view them as stages:

- Minimize borrowing by prioritizing grants and scholarships in your Student Finance USA plan.

- Choose federal options first because federal loans often include protections that private loans do not.

- Plan your repayment while you’re still in school so your Student Finance USA exit strategy is ready when your grace period ends.

Approaching Student Finance USA this way reduces anxiety and improves outcomes.

10 Digital Skills for Future-Proof Your Career in 2025

Types of aid in Student Finance USA

When you explore Student Finance USA, you’ll encounter four major forms of help:

- Grants & scholarships — free money that does not need to be repaid; a core part of Student Finance USA.

- Work-study — campus jobs that can fund part of your expenses while building experience; another Student Finance USA tool.

- Federal loans — subsidized, unsubsidized, and PLUS loans backed by the government; often the first stop in Student Finance USA.

- Private loans — bank or credit-union loans used to fill gaps; part of Student Finance USA but usually riskier.

The principle of Student Finance USA: always hunt for free money first, then consider federal help, and treat private loans as a last resort.

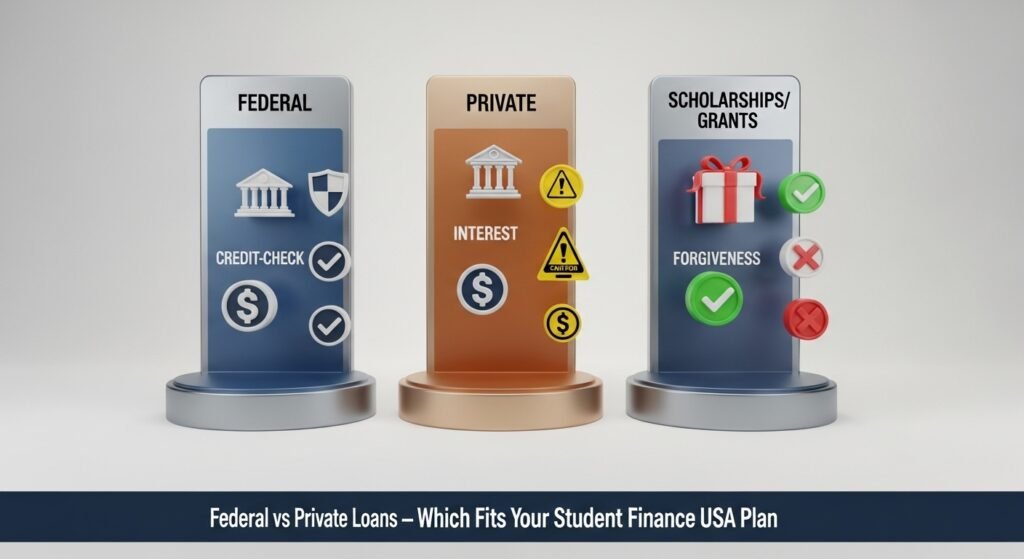

Quick comparison — Student Finance USA at a glance

| Feature | Federal Loans | Private Loans | Scholarships/Grants |

|---|---|---|---|

| Credit check | Usually no | Yes | No |

| Flexible repayment | Yes | Often no | N/A |

| Forgiveness options | Possible | Rare | N/A |

| Best in Student Finance USA for | Safety nets & low risk | Gap financing | Reducing total borrowing |

This short table will help you keep Student Finance USA tradeoffs clear when comparing offers.

How to apply — Student Finance USA steps

- Start early. FAFSA opens every October — file as soon as possible to maximize Student Finance USA opportunities.

- Gather documents. W-2s, tax returns, Social Security numbers, and bank info are essential for Student Finance USA forms.

- Apply for scholarships concurrently. Local scholarships are smaller but less competitive — a key Student Finance USA tactic.

- Compare award letters. Treat institutional aid as part of your Student Finance USA evaluation.

- Ask financial aid offices questions. They’re an underused resource in Student Finance USA decisions.

Filing FAFSA is the most important step in Student Finance USA — it unlocks federal aid and often school-based packages.

10 Digital Skills for Future-Proof Your Career in 2025

Federal vs. private loans — the Student Finance USA reality

From personal experience and thousands of borrower stories, here’s what matters most in Student Finance USA decisions:

- Federal protections: Many federal loans pause interest while you’re in school (subsidized loans) or offer flexible repayment through income-driven plans. This is central to Student Finance USA strategy.

- Private loan risk: Private loans may carry lower rates for borrowers with excellent credit, but they usually lack deferment, forbearance, or forgiveness options — a major Student Finance USA downside if your income fluctuates.

- Cosigners & terms: If you use private loans within your Student Finance USA plan, a cosigner can help get a better rate — but that person becomes legally responsible if you can’t pay.

In Student Finance USA, treating federal loans as the default and private loans as supplemental usually gives the best long-term results.

Smart repayment strategies in Student Finance USA

- Start with a plan: Pick a repayment approach before the first bill arrives. This is a smart Student Finance USA move.

- Income-driven repayment (IDR): If your early-career salary is low, IDR can reduce payments and protect you during lean periods — a staple of Student Finance USA.

- Targeted extra payments: After building a small emergency fund, direct extra payments at principal to shorten loan life; this is a strategic Student Finance USA tactic.

- Refinance cautiously: Refinancing can reduce rates but may remove federal protections — weigh this in any Student Finance USA decision.

- Autopay benefits: Many servicers offer small rate reductions for autopay; it’s a low-effort Student Finance USA win.

The mindset here: Student Finance USA isn’t about panic payments — it’s about small, consistent choices that compound.

Best Free Courses Online with Certificates in 2025

Forgiveness programs and Student Finance USA

There are targeted forgiveness programs that alter the long-term math of Student Finance USA:

- Public Service Loan Forgiveness (PSLF): After 120 qualifying payments while working for eligible employers, some federal loans can be forgiven — a powerful Student Finance USA option for public-sector careers.

- Teacher loan forgiveness and sector-specific programs: Certain professions qualify for partial or full loan cancellation, which can be a decisive factor in Student Finance USA planning.

If forgiveness is part of your Student Finance USA route, meticulous documentation and yearly checks are non-negotiable.

Taxes and Student Finance USA

Student loan interest can often be deducted (up to statutory limits) on tax returns, which is a modest but useful Student Finance USA benefit. Track interest paid each year and consult tax guidance to include this as part of your Student Finance USA financial planning.

Best Free Courses Online with Certificates in 2025

Practical, lesser-known Student Finance USA tips

- Micro-scholarships add up: Small awards can reduce borrowing considerably over time. Treat micro-scholarships as a core Student Finance USA tactic.

- Use work-study strategically: Choose roles that build skills relevant to your career goals — this is both income and investment in Student Finance USA terms.

- Keep a loan spreadsheet: For Student Finance USA clarity, record each loan, servicer, balance, rate, and payoff target in one place.

- Read servicer emails: Messages from servicers can contain important Student Finance USA instructions and changes. Don’t ignore them.

These small steps are what separates good Student Finance USA outcomes from average ones.

Best Free Courses Online with Certificates in 2025

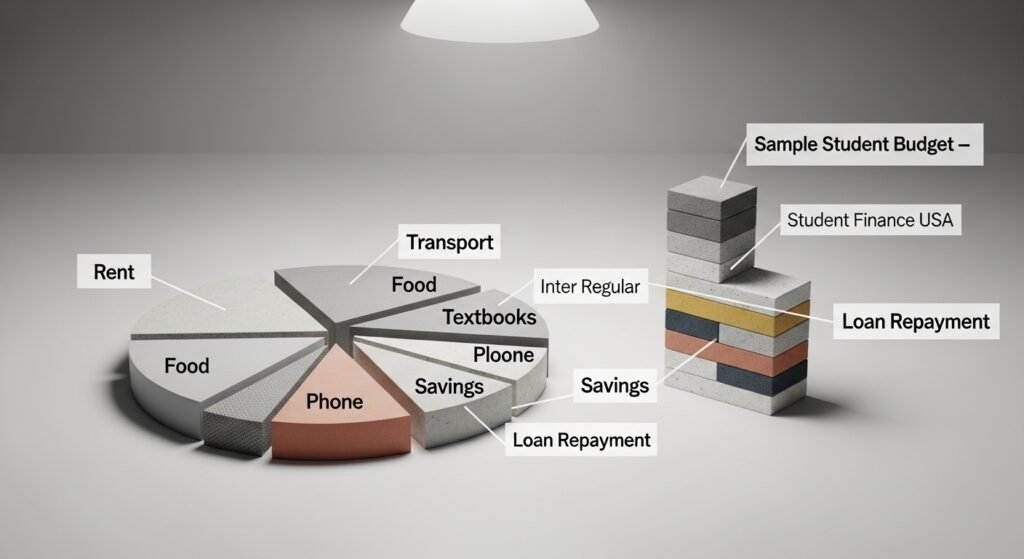

Example monthly student budget (Student Finance USA friendly)

- Rent & utilities: $700

- Groceries: $250

- Transport: $80

- Phone & internet: $60

- Textbook savings: $50

- Emergency savings: $50

- Loan repayment (during school or grace): $100

A realistic Student Finance USA budget stays simple, prioritizes essentials, and reserves small amounts for savings and debt reduction.

Common Student Finance USA mistakes to avoid

- Borrowing without a plan. Don’t treat loans as a blank check — it’s a common Student Finance USA error.

- Over-relying on private loans. Private options are tempting, but they often lack Student Finance USA protections.

- Skipping annual reviews for IDR. Forgetting to recertify can change your payments and derail Student Finance USA benefits.

- Ignoring autopay discounts. Even small savings are meaningful in Student Finance USA math.

Avoid these pitfalls and Student Finance USA becomes far less stressful.

Visuals and tools to include with your Student Finance USA content

- A clear infographic: timeline of a loan (Borrow → In-school → Grace → Repayment → Forgiveness) — great for Student Finance USA readers.

- A loan comparison table (federal vs. private) — essential Student Finance USA reference.

- Monthly payment calculators and a downloadable Student Finance USA loan-tracking spreadsheet.

Visuals make Student Finance USA concepts stick.

Career Development Courses That Really Lead to Job Offers in 2025

Two short, realistic Student Finance USA case studies

Case 1 — Public college graduate (Anna):

Anna leaned on federal Direct Loans and scholarships as part of her Student Finance USA plan. After graduation, she enrolled in an IDR plan while taking a nonprofit job. Over time, her Student Finance USA choices led to manageable payments and eventual eligibility for PSLF.

Case 2 — Private college graduate (Marcus):

Marcus mixed federal loans with private gap financing in his Student Finance USA strategy. After three years of salary growth, he refinanced his private loans to lower rates while leaving federal loans untouched for potential Student Finance USA forgiveness options.

Both examples show how mixing Student Finance USA tools thoughtfully can produce better outcomes than a one-size-fits-all approach.

Where to get trustworthy Student Finance USA help

For reliable information about Student Finance USA, always check official sources like federal student aid websites, consumer protection resources, and the IRS for tax rules. These sites are essential for current Student Finance USA rules and deadlines.

Final thoughts — make Student Finance USA work for you

Student Finance USA doesn’t have to be intimidating. Start with small, steady actions: file FAFSA early, pursue scholarships every semester, favor federal loans where possible, and track your loans in one place. Those Student Finance USA habits — repeated over time — create breathing room, options, and peace of mind.

10 Digital Skills for Future-Proof Your Career in 2025

Call to action

If this rewrite helped you see Student Finance USA more clearly, share it with a friend who’s starting college applications. For a practical next step, download a free Student Finance USA loan-tracking spreadsheet and a simple budget template to get your finances organized today.

Pingback: How Metacognitive Routines Build in Middle School ELA - PaidScripts -Tech Education Hub: Courses & Student Resources

Pingback: 3 Fun Ways to Build a Science Classroom Community - PaidScripts -Tech Education Hub: Courses & Student Resources