Financial Savvy in a Shifting Landscape: Managing Money as a Young Adult in the Future of Work

Do you remember those dusty old textbooks that talked about a steady job, a predictable career path, and a comfortable retirement fund? As an educator and tech enthusiast, I can tell you that for today’s young adults, that vision of the future of work feels more like a fairy tale than a roadmap. The reality is far more dynamic: a gig economy, a rapidly evolving job market, and a constant need for upskilling. This isn’t just about changing how we earn; it’s fundamentally changing how we manage our money.

As I guide students and professionals at PaidScripts.com, I constantly emphasize that technical skills alone aren’t enough. In this brave new world, financial literacy isn’t just a useful skill; it’s a critical survival tool. It’s the compass that helps young adults navigate the often-turbulent waters of flexible incomes, diverse income streams, and long-term financial goals that might look very different from their parents’ generation. This isn’t about becoming a Wall Street guru; it’s about building resilience, making informed choices, and securing your place in the exciting, yet uncertain, future of work.

Essential Climate Change Education for Students

Why “Old School” Financial Advice Doesn’t Cut It Anymore

The financial advice many of us grew up with—”get a good job, save diligently in your 401(k), and buy a house”—was solid for a stable, industrial-era economy. But that’s not the world young adults are entering. The future of work is characterized by:

- The Gig Economy: More freelancers, contractors, and side hustlers mean income can be irregular and unpredictable.

- Rapid Career Shifts: The idea of staying with one company for decades is largely gone. Many will have multiple careers, not just jobs.

- Student Debt Crisis: A significant burden for many graduates, impacting early financial decisions.

- Inflationary Pressures: The rising cost of living means every dollar needs to work harder.

Given these shifts, relying solely on traditional financial planning can leave young adults feeling unprepared and overwhelmed. As an educator, I’ve seen firsthand how a lack of tailored financial literacy can hinder even the most talented individuals from achieving their full potential in this new economic landscape.

Traditional vs. Future-Ready Financial Planning

The approach to managing money needs to evolve as much as the job market itself.

| Traditional Financial Planning (Past/Present) | Future-Ready Financial Planning (For the Future of Work) |

| Income Type: Assumes stable, salaried income. | Income Type: Embraces variable income from multiple sources (gig work, side hustles). |

| Focus: Linear career progression, company benefits. | Focus: Skill-based earning, self-funded benefits (healthcare, retirement). |

| Savings Goal: Retirement in one employer’s plan. | Savings Goal: Emergency funds for income gaps, diversified investments beyond traditional employer plans. |

| Debt View: Avoid all debt where possible. | Debt View: Strategic debt (e.g., for upskilling) can be an investment. |

| Risk Tolerance: Often conservative, employer-managed risk. | Risk Tolerance: Requires higher personal risk assessment and management. |

Export to Sheets

The Core Pillars of Financial Literacy for the Future of Work

So, what does it actually mean to be financially literate in this dynamic environment? It means mastering a few key areas, tailored for flexibility and resilience.

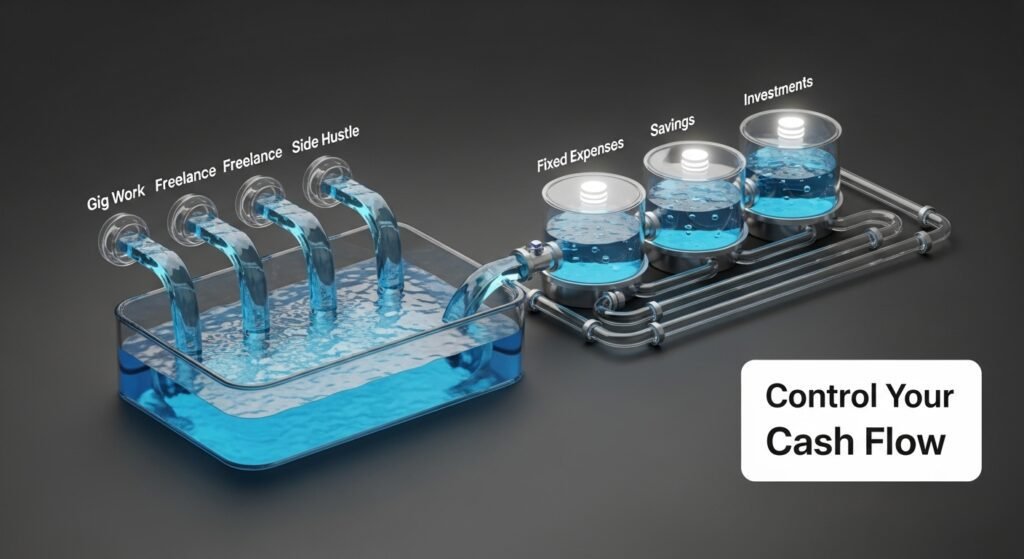

1. Dynamic Budgeting: The Art of Managing Variable Income

Budgeting isn’t about restriction; it’s about control. And when your income isn’t fixed, your budget can’t be either.

- The “Zero-Based” Approach: Every dollar has a job. This is especially powerful for variable incomes. At the start of each month (or pay cycle), allocate every incoming dollar to a specific category (rent, food, savings, investment). When the next payment comes in, you adjust.

- The “Income Bucket” Strategy: As an entrepreneur myself at PaidScripts.com, I’ve found this invaluable. Designate “buckets” for your income:

- Fixed Expenses: Enough to cover rent, utilities, minimum debt payments.

- Savings/Investment: A percentage (e.g., 10-20%) that always goes here first.

- Buffer/Emergency: For those lean months or unexpected expenses.

- Discretionary: What’s left for fun.

- Tools for Success: Utilize apps like Mint, YNAB (You Need A Budget), or even a simple spreadsheet. The key is finding a system that works for your unpredictable income.

Essential Climate Change Education for Students

2. Strategic Saving: Beyond the Rainy Day Fund

An emergency fund is critical, but the future of work demands more.

- The 3-6-9 Month Rule: Instead of a generic 3-6 months of expenses, young adults in the gig economy should aim for 6-9 months, or even a year, in a high-yield savings account. This provides a crucial buffer during income droughts.

- Saving for Investment: Your savings shouldn’t just sit there. Once your emergency fund is solid, start saving specifically for investments. The earlier you start, the more powerful compound interest becomes.

- Skill-Based Savings: As a tech enthusiast, I always advocate for continuous learning. Set aside funds specifically for upskilling courses, certifications, or workshops. This is an investment in your future earning potential, which is the most valuable asset in the future of work.

3. Smart Investing: Building Wealth for a Non-Traditional Path

Investing is no longer just for the wealthy or those with corporate 401(k)s. It’s accessible to everyone.

- Start Early, Start Small: Even $50 a month can make a huge difference over decades. Apps like Acorns or Stash allow you to start with spare change.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Explore a mix of:

- Index Funds/ETFs: Low-cost, diversified investments that track the market.

- Real Estate (Indirectly): REITs (Real Estate Investment Trusts) allow you to invest in real estate without buying a whole property.

- Self-Directed Retirement Accounts: If you’re freelancing, explore a SEP IRA or Solo 401(k).

- Understand Risk vs. Reward: The younger you are, the more time you have to recover from market downturns, allowing for a slightly higher risk tolerance in your long-term investments.

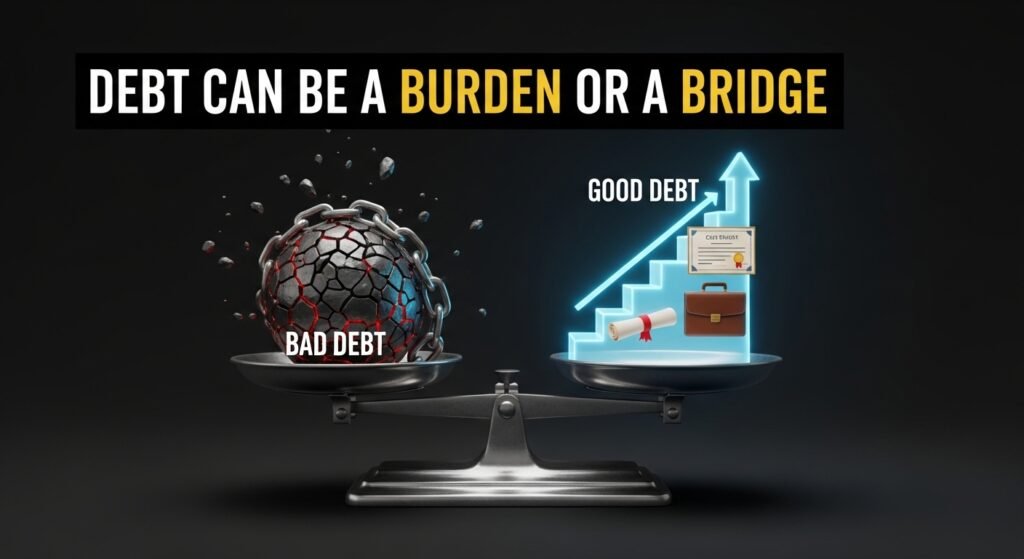

4. Debt Management: Good Debt vs. Bad Debt

Not all debt is created equal. Knowing the difference is crucial.

- Bad Debt: High-interest consumer debt like credit cards (if not paid off monthly). This debt often depreciates, meaning you’re paying interest on something losing value.

- Good Debt: Debt used to acquire an asset that appreciates or generates income, or debt that leads to higher earning potential. Examples include student loans (if they lead to a high-value degree), a mortgage (for an appreciating asset), or a loan for a business venture.

- Strategy: Prioritize paying off high-interest bad debt first. For good debt, focus on responsible repayment and understanding its return on investment.

STEM Careers in Future of Work for Graduates

A Personal Insight: My Journey from Code to Cash Flow

When I first started my journey in tech and education, my focus was entirely on building skills and creating useful resources like PaidScripts.com. I was passionate, but my financial literacy was, to put it mildly, basic. I remember thinking that if I just built a great product, the money would automatically handle itself. Boy, was I wrong!

I quickly learned that even with a strong income, if you don’t understand budgeting for variable revenue, strategic saving for slow periods, or the power of early investing, you’re building on shaky ground. It was through my own journey of becoming an educator and entrepreneur that I realized the critical link between technical skill and financial acumen. My passion for simplifying complex topics extended beyond coding to explaining how to make your money work for you, not against you, in the dynamic world we inhabit. This experience now informs every piece of advice I share.

Conclusion: Your Financial Future, Your Control

The future of work is undoubtedly exciting, filled with unprecedented opportunities for innovation, flexibility, and personal growth. But with great freedom comes great responsibility, especially when it comes to your finances. For young adults, financial literacy is no longer just a “nice-to-have”; it’s an indispensable toolkit for success, resilience, and true independence.

By mastering dynamic budgeting, strategic saving, smart investing, and responsible debt management, you’re not just preparing for a job; you’re building a robust financial foundation that can withstand the shifts and capitalize on the opportunities of tomorrow. Take control of your money, and you take control of your future of work.

What’s one financial habit you’re committed to building this year? Share your goal in the comments below!